All Categories

Featured

Table of Contents

Numerous whole, global and variable life insurance policy plans have a cash worth part. With one of those policies, the insurer transfers a portion of your regular monthly premium payments into a cash worth account. This account gains interest or is spent, aiding it grow and supply a much more significant payout for your beneficiaries.

With a level term life insurance policy, this is not the situation as there is no cash money value element. Therefore, your policy won't expand, and your death advantage will certainly never enhance, consequently restricting the payment your beneficiaries will get. If you desire a policy that provides a survivor benefit and constructs money value, explore entire, global or variable strategies.

The 2nd your plan expires, you'll no more have life insurance policy protection. It's often feasible to renew your plan, but you'll likely see your costs increase significantly. This might present problems for retired people on a fixed income since it's an added cost they could not be able to afford. Level term and reducing life insurance coverage deal comparable plans, with the major distinction being the fatality advantage.

(EST).2. Online applications for the are readily available on the on the AMBA website; click the "Apply Now" blue box on the right hand side of the web page. NYSUT members can additionally publish out an application if they would favor by clicking on the on the AMBA internet site; you will certainly then require to click "Application Type" under "Kinds" on the right-hand man side of the web page.

How much does Tax Benefits Of Level Term Life Insurance cost?

NYSUT participants enrolled in our Degree Term Life Insurance policy Plan have access to offered at no added price. The NYSUT Member Benefits Trust-endorsed Degree Term Life Insurance policy Strategy is underwritten by Metropolitan Life Insurance Firm and provided by Association Participant Perks Advisors. NYSUT Student Members are not eligible to join this program.

Term life insurance is a cost effective and uncomplicated option for many individuals. You pay premiums on a monthly basis and the coverage lasts for the term size, which can be 10, 15, 20, 25 or three decades. Yet what happens to your premium as you age relies on the kind of term life insurance policy coverage you purchase.

As long as you remain to pay your insurance policy costs every month, you'll pay the same price throughout the whole term length which, for many term plans, is usually 10, 15, 20, 25 or thirty years (Tax benefits of level term life insurance). When the term finishes, you can either select to finish your life insurance protection or restore your life insurance policy plan, normally at a greater rate

Why should I have Level Term Life Insurance Coverage?

For example, a 35-year-old lady in exceptional wellness can acquire a 30-year, $500,000 Sanctuary Term policy, provided by MassMutual beginning at $29.15 each month. Over the following 30 years, while the policy is in location, the expense of the protection will certainly not change over the term duration. Allow's face it, the majority of us do not like for our bills to grow with time.

Your degree term price is identified by a variety of aspects, many of which are related to your age and wellness. Various other elements include your specific term plan, insurance coverage carrier, benefit amount or payout. Throughout the life insurance policy application process, you'll respond to questions regarding your wellness background, consisting of any pre-existing conditions like an essential ailment.

It's always very essential to be honest in the application procedure. Issuing the plan and paying its advantages relies on the candidate's evidence of insurability which is determined by your response to the health and wellness concerns in the application. A medically underwritten term policy can secure in a budget-friendly rate for your coverage duration, whether that be 10, 15, 20, 25 or three decades, despite just how your wellness might transform throughout that time.

With this kind of degree term insurance coverage, you pay the exact same monthly premium, and your recipient or beneficiaries would certainly obtain the exact same benefit in case of your death, for the whole coverage period of the plan. So just how does life insurance policy work in regards to price? The cost of level term life insurance policy will rely on your age and health as well as the term length and coverage quantity you select.

What should I look for in a Tax Benefits Of Level Term Life Insurance plan?

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Women$1,000,00030$43.3135 Male$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Female$800,00015$27.72 Price quote based on prices for eligible Haven Simple candidates in exceptional health. Prices distinctions will certainly vary based upon ages, wellness condition, protection quantity and term size. Haven Simple is currently not available in DE, ND, NY, and SD.Regardless of what coverage you pick, what the policy's money worth is, or what the swelling sum of the fatality benefit becomes, assurance is among one of the most valuable benefits connected with purchasing a life insurance policy plan.

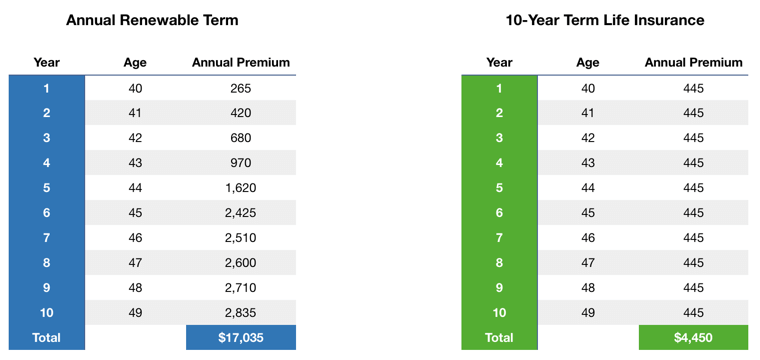

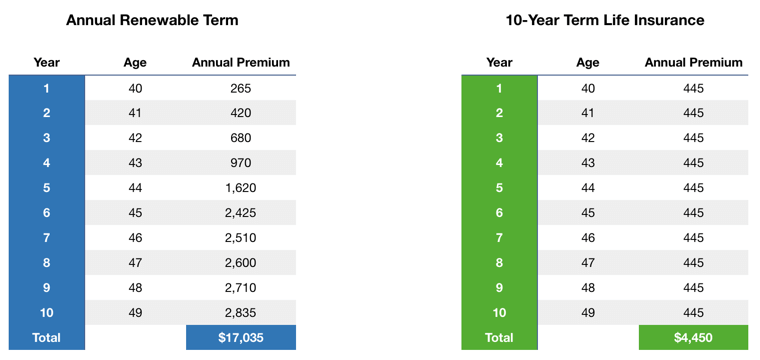

Why would certainly a person pick a policy with a yearly sustainable premium? It might be an alternative to think about for somebody who requires insurance coverage only temporarily.

You can generally renew the plan each year which gives you time to consider your options if you desire protection for longer. Understand that those alternatives will certainly include paying greater than you made use of to. As you grow older, life insurance policy premiums become substantially a lot more costly. That's why it's handy to acquire the right amount and length of coverage when you first obtain life insurance policy, so you can have a low rate while you're young and healthy and balanced.

If you contribute important unpaid labor to the household, such as child treatment, ask on your own what it may set you back to cover that caretaking job if you were no much longer there. Then, make sure you have that coverage in area to ensure that your household receives the life insurance policy benefit that they need.

How do I cancel Level Term Life Insurance Policy?

For that collection quantity of time, as long as you pay your premium, your price is stable and your beneficiaries are safeguarded. Does that indicate you should constantly select a 30-year term size? Not necessarily. As a whole, a shorter term policy has a lower costs price than a much longer plan, so it's wise to choose a term based upon the predicted size of your monetary duties.

These are all essential factors to bear in mind if you were thinking about picking an irreversible life insurance such as an entire life insurance plan. Many life insurance policy plans offer you the option to add life insurance coverage cyclists, believe extra benefits, to your policy. Some life insurance coverage plans feature cyclists integrated to the expense of premium, or motorcyclists might be offered at a price, or have actually costs when worked out.

With term life insurance, the interaction that lots of people have with their life insurance policy company is a month-to-month costs for 10 to 30 years. You pay your regular monthly costs and wish your family will never ever need to utilize it. For the team at Sanctuary Life, that felt like a missed possibility.

Table of Contents

Latest Posts

What should I look for in a Fixed Rate Term Life Insurance plan?

What is the process for getting Level Term Life Insurance For Seniors?

How Does Term Life Insurance Policy Work?

More

Latest Posts

What should I look for in a Fixed Rate Term Life Insurance plan?

What is the process for getting Level Term Life Insurance For Seniors?

How Does Term Life Insurance Policy Work?