All Categories

Featured

Table of Contents

- – What does a basic 20-year Level Term Life Insu...

- – What should I look for in a Level Term Life In...

- – Why is Level Term Life Insurance For Families...

- – Who offers flexible Guaranteed Level Term Lif...

- – How do I compare Low Cost Level Term Life In...

- – Is Fixed Rate Term Life Insurance worth it?

Costs are usually less than entire life policies. With a level term plan, you can choose your protection amount and the plan size. You're not locked into an agreement for the rest of your life. Throughout your policy, you never ever have to worry regarding the costs or fatality benefit quantities transforming.

And you can't pay out your policy throughout its term, so you will not receive any type of economic benefit from your past insurance coverage. Just like other sorts of life insurance coverage, the expense of a degree term plan depends upon your age, coverage requirements, work, way of living and wellness. Commonly, you'll locate more inexpensive insurance coverage if you're younger, healthier and much less high-risk to insure.

Considering that level term costs stay the exact same for the duration of insurance coverage, you'll know precisely just how much you'll pay each time. That can be a large help when budgeting your expenditures. Level term protection likewise has some versatility, permitting you to personalize your policy with extra functions. These commonly come in the form of cyclists.

You may have to meet details problems and credentials for your insurance firm to establish this biker. There additionally could be an age or time limit on the protection.

What does a basic 20-year Level Term Life Insurance plan include?

The death benefit is usually smaller, and insurance coverage usually lasts up until your child turns 18 or 25. This cyclist may be a more economical method to help guarantee your children are covered as riders can commonly cover multiple dependents at the same time. Once your child ages out of this coverage, it may be feasible to convert the motorcyclist into a new policy.

The most usual kind of long-term life insurance is entire life insurance, yet it has some essential distinctions compared to degree term protection. Right here's a basic summary of what to consider when comparing term vs.

Whole life entire lasts insurance coverage life, while term coverage lasts insurance coverage a specific periodDetails The premiums for term life insurance are normally lower than whole life insurance coverage.

What should I look for in a Level Term Life Insurance Quotes plan?

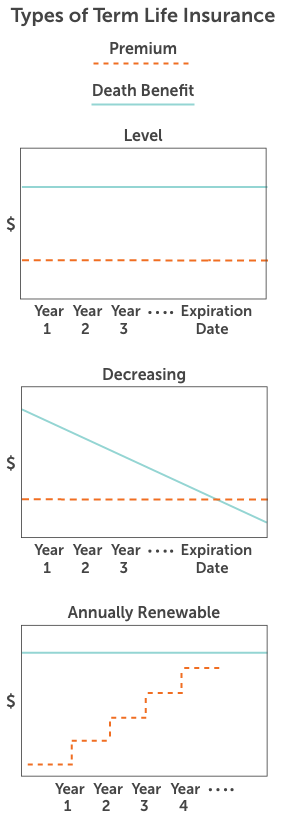

One of the major attributes of level term insurance coverage is that your premiums and your death advantage don't alter. You may have insurance coverage that starts with a fatality benefit of $10,000, which can cover a mortgage, and then each year, the fatality advantage will reduce by a collection amount or percent.

Due to this, it's usually a much more budget friendly type of level term insurance coverage., however it might not be adequate life insurance coverage for your demands.

After picking a plan, complete the application. For the underwriting procedure, you may need to offer basic individual, health and wellness, way of living and work information. Your insurance firm will establish if you are insurable and the threat you might offer to them, which is shown in your premium costs. If you're accepted, authorize the paperwork and pay your very first costs.

You might desire to update your recipient details if you've had any kind of significant life changes, such as a marital relationship, birth or separation. Life insurance can sometimes really feel complicated.

Why is Level Term Life Insurance For Families important?

No, degree term life insurance coverage doesn't have money worth. Some life insurance policy policies have an investment function that permits you to construct money worth with time. Level term life insurance policy. A part of your costs settlements is alloted and can gain rate of interest over time, which grows tax-deferred during the life of your coverage

These plans are commonly substantially a lot more costly than term protection. You can: If you're 65 and your coverage has run out, for instance, you may want to get a new 10-year level term life insurance plan.

Who offers flexible Guaranteed Level Term Life Insurance plans?

You might have the ability to convert your term protection right into a whole life policy that will certainly last for the rest of your life. Many kinds of degree term plans are exchangeable. That suggests, at the end of your protection, you can transform some or all of your policy to entire life protection.

Level term life insurance coverage is a plan that lasts a set term generally between 10 and three decades and includes a level death advantage and degree premiums that stay the same for the whole time the plan is in effect. This implies you'll recognize exactly how much your settlements are and when you'll have to make them, permitting you to budget appropriately.

Level term can be a great choice if you're looking to acquire life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Barometer Research, 30% of all grownups in the U.S. demand life insurance and do not have any type of sort of policy yet. Degree term life is foreseeable and budget-friendly, that makes it one of the most popular sorts of life insurance policy

A 30-year-old male with a comparable profile can anticipate to pay $29 each month for the same protection. AgeGender$250,000 coverage amount$500,000 protection quantity$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Approach: Ordinary regular monthly rates are calculated for male and female non-smokers in a Preferred wellness classification getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

How do I compare Low Cost Level Term Life Insurance plans?

Prices might vary by insurer, term, insurance coverage amount, health and wellness class, and state. Not all policies are readily available in all states. Price picture valid as of 09/01/2024. It's the least expensive kind of life insurance policy for the majority of people. Degree term life is far more budget-friendly than a comparable whole life insurance policy policy. It's simple to handle.

It enables you to budget plan and prepare for the future. You can easily factor your life insurance coverage right into your spending plan because the costs never ever transform. You can prepare for the future simply as quickly due to the fact that you recognize specifically just how much money your enjoyed ones will get in the event of your absence.

Is Fixed Rate Term Life Insurance worth it?

In these cases, you'll usually have to go through a new application process to obtain a better rate. If you still require coverage by the time your degree term life policy nears the expiration date, you have a couple of choices.

Table of Contents

- – What does a basic 20-year Level Term Life Insu...

- – What should I look for in a Level Term Life In...

- – Why is Level Term Life Insurance For Families...

- – Who offers flexible Guaranteed Level Term Lif...

- – How do I compare Low Cost Level Term Life In...

- – Is Fixed Rate Term Life Insurance worth it?

Latest Posts

Funeral Insurance For Under 50

Funeral Expense Insurance Plan

Funeral Insurance Quote

More

Latest Posts

Funeral Insurance For Under 50

Funeral Expense Insurance Plan

Funeral Insurance Quote